You may have heard the term "finternet" before, but what does it really mean? In this article, we'll delve into the concept of finternet, its inner workings, and its potential to transform the financial landscape.

What is Finternet?

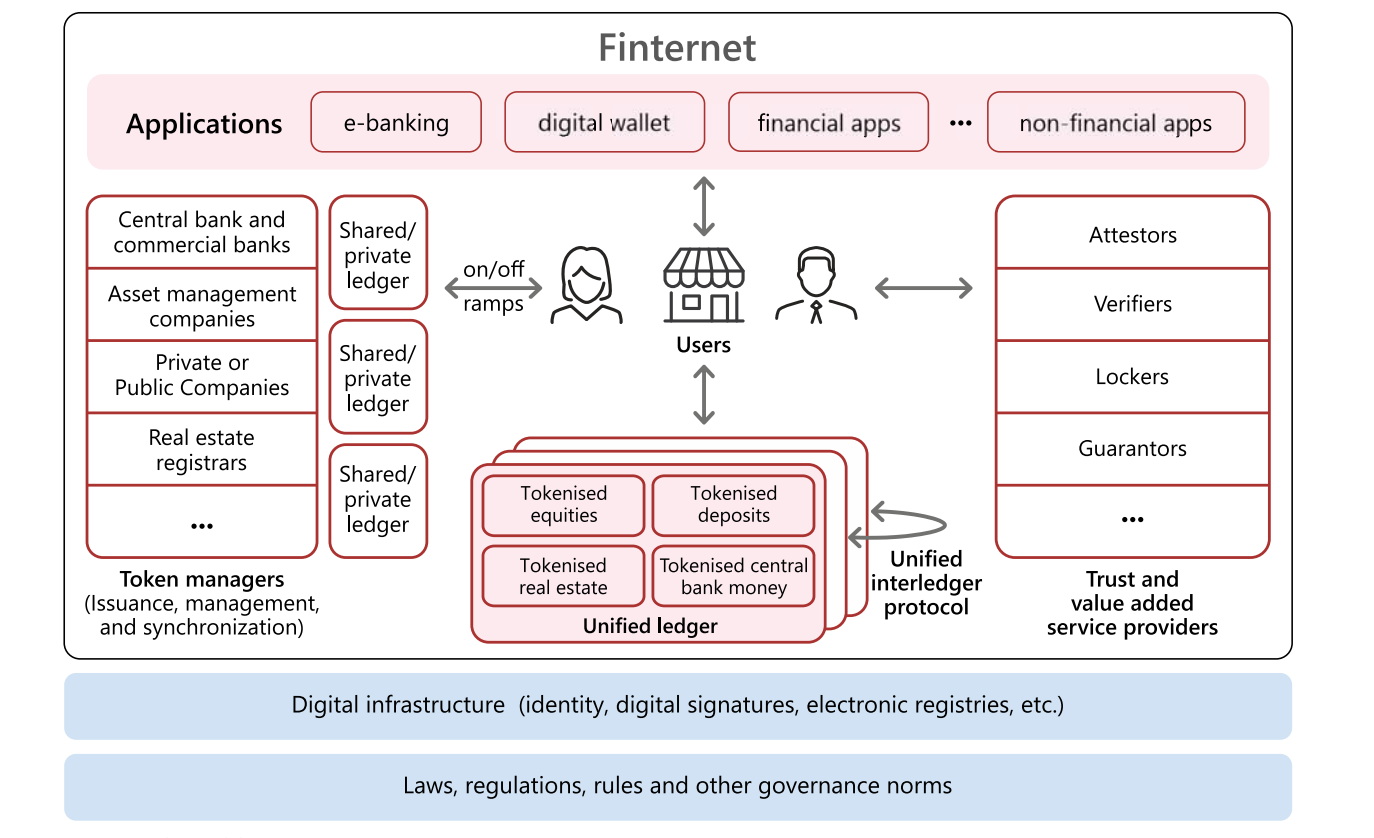

Finternet simply means multiple financial ecosystems connected to each other through internet, just like how computers are connected to each other/ If you have studied aboout topology, it is something similar, each ecosystem is connected to each other in a decentralized manner and share resources. It aims to lower barriers between different financial services and systems, making financial transactions cheaper, faster, more secure, and accessible to everyone.

Key Features of Finternet are:

User-centric approach

Interoperability between different financial systems and assets

Faster, cheaper, and more secure financial transactions

Near-instantaneous settlement of transactions

Broader access to financial services for all, including those currently underserved

Ability to transfer any financial asset, in any amount, at any time, using any device, to anyone, anywhere in the world

Evolution of Digital Finance

Traditional banks began offering online banking services that allowed customers to manage their accounts, transfer funds, and pay bills via the internet. This was a revolutionary shift from the conventional banking methods that required physical presence at a branch. The introduction of these online services laid the groundwork for the financial internet, or "Finternet," by making financial transactions more accessible, efficient, and convenient for users worldwide.

One of the earliest form of digital payment was PayPal which was founded in 1998. Paypal provided a simple and secure mode of payment for individuals and businesses to transfer money from one place to other seamlessly through internet. It quickly became a standard for e-commerce transactions, for its easy to use User experience and setting up an account with email and a credit card.

As the 2000s progressed, there was a gradual but significant shift from traditional financial systems to fully digital, such as Digital Wallets like ApplePay, GooglePay etc., which made purchases easier with a simple tap or click.

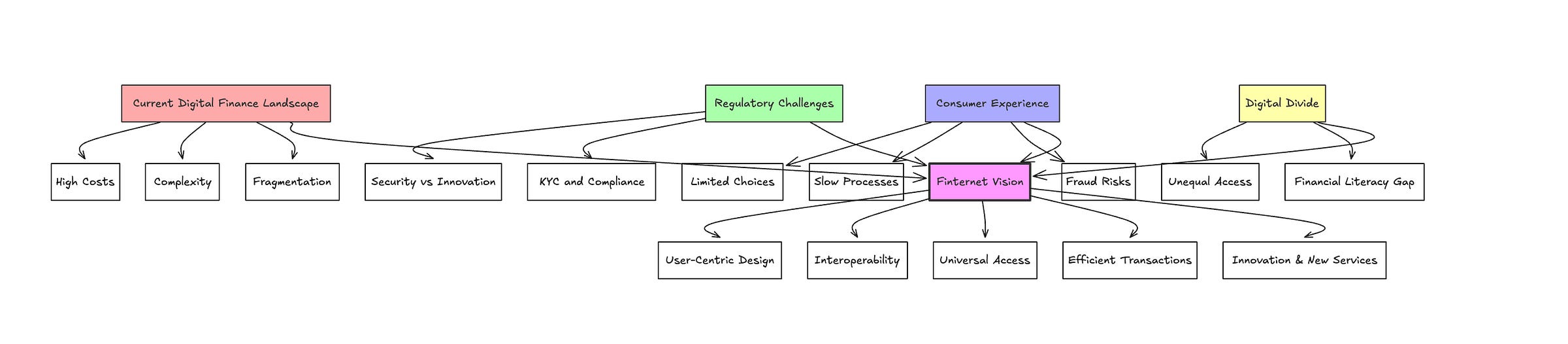

The current state of Digital Finance

The digital finance world has a lot of potential, but it's held back by several problems:

- High costs due to outdated systems that don't work well together

- Complicated processes that make it hard for people to use financial services

- Different rules and regulations that don't always line up

Rules like KYC (Know Your Customer) are important for security but can slow things down

Too many strict rules can stop new ideas from happening and too few rules might make the system unsafe

Traditional banking often lacks choices and relies on outdated, paper-based processes that are slow and error-prone, while new digital banks struggle to integrate with older systems. This digital divide is evident in the unequal access to financial technology, where some enjoy cutting-edge apps and services, while others, particularly in remote areas, have limited access, hindering equal benefits from these advancements.

The image looks a bit confusing right? with all the interconnections, and stuff. Exactly, this the fragmented state of current financial system

The Finternet would simplify these connections, standardise processes, and include previously excluded users, creating a more efficient and accessible financial ecosystem.

What is DPI?

Digital Public Infrastructure is a framework, which acts as a foundation for digital systems and platforms that support essential public services and societal functions.

DPI aims to make changes to the ecosystem by:

Making things more fair and open for everyone

Allowing countries to skip older technologies and jump to newer ones

Creating new ways of running things (governance)

Adopting new technologies

India's strategic use and scaling of Digital Public Infrastructure (DPI) have rapidly advanced its digital economy, bypassing traditional growth timelines. With Aadhaar providing ultra-low-cost authentication for over 1.39 billion users, and the Unified Payments Interface (UPI) transforming the payments landscape expanding from 50 million to over 500 million users. India has made digital services and financial inclusion widely accessible. The success of DigiLocker, with over 6.2 billion Verifiable Credentials issued, highlights the transformative power of DPI in enabling seamless, user-controlled access to essential services.

DPI focus on three major concerns:

The right technology setup

Fair and open rules for everyone to follow

Encouragement for both government and businesses to create new things

DPI isn't a complete solution, but it's like a foundation that allows for many different innovations. It helps connect different sectors like finance, healthcare, education, shopping, and energy.

DPI has been architected with few characteristics such as :

Reusability: It is like a shared framework that can be built on top of, kinda like foundation of blocks for 3rd party vendors or users to build on on top of DPI.

Enable Private Innovation: The core agenda of DPI is to design an infrastructure that private players can utilize to give citizens, an affordable and inclusive access to market, products and services. For example Fintechs have used India’s Unified Payment Interface (UPI) to create new categories of products like autopay, merchant soundbox (Paytm Soundbox) ,etc.

Ecosystem Adoption: As per July 2024, over 605 banks are live on UPI, with over 14.4Bn USD in Volume.

Asynchronous adoption: It was necessary to design these systems assuming that various entities would adopt them at different points in time. This approach allows different use cases and sectors to adopt the infrastructure asynchronously.

Blockchain and DeFi

Blockchain technology is a decentralized system that records transactions across many computers, ensuring transparency and security without needing a central authority. This technology is the foundation for decentralized finance (DeFi), which aims to fix the common drawbacks of traditional financial systems.

Decentralized Finance (DeFi) is a financial technology that leverages blockchain and cryptocurrencies to provide financial services without the need for traditional centralized financial institutions. It operates on a decentralized, distributed ledger system, ensuring transparency, security, and autonomy for users. DeFi platforms enable peer-to-peer transactions, lending, borrowing, trading, and other financial services through smart contracts, which are self-executing contracts with the terms of the agreement written directly into code.

The three eyes of Finternet:

User - Centric : A user-centric framework prioritizes the needs and experiences of both individuals and organizations. This means creating financial tools and services that are intuitive, accessible, and tailored to the specific needs of different users. For retail users, this could involve personalized financial services like budgeting apps, mobile banking, and peer-to-peer payment platforms that are easy to use and available on multiple devices.

For instance, through decentralized finance (DeFi) platforms, users can manage their assets, engage in lending or borrowing, and participate in financial markets without relying on intermediaries.

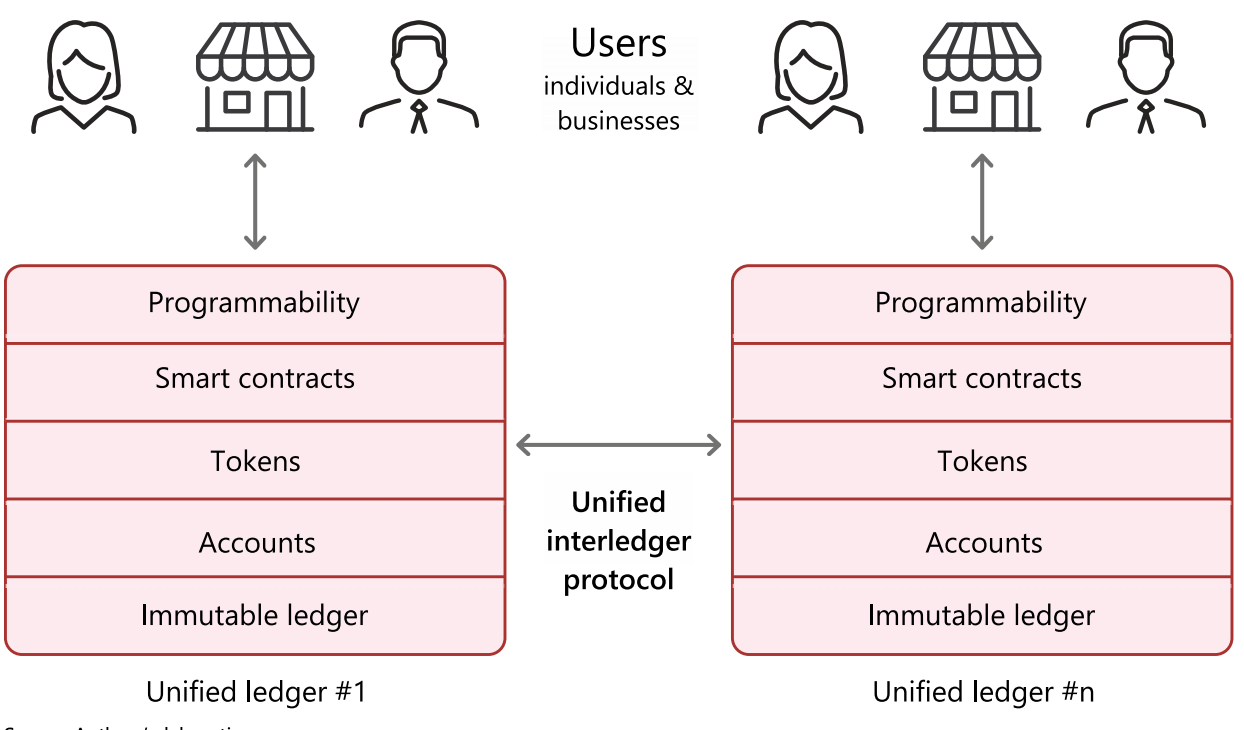

Unified: A unified framework integrates a wide range of asset types and sectors into a cohesive system which focus on bringing together various financial products and services such as payments, lending, investing, insurance, and more into a single, interoperable network. This integration enables users to seamlessly manage and transfer assets across different platforms and sectors, whether they are dealing with traditional financial instruments like stocks and bonds, digital assets like cryptocurrencies, or even real-world assets that have been tokenized.

Universality: The principle of universality in the Finternet ensures accessibility for everyone, from individuals to large corporations, by designing inclusive and easy-to-use platforms. It fosters broad participation, encouraging innovation and competition across diverse stakeholders. As the system grows, it remains scalable and adaptable, evolving with new technologies and user needs while maintaining accessibility and inclusivity.

Tokenization

Tokenization in the context of the Finternet refers to the process of converting physical or digital assets into digital tokens that can be stored, transferred, and traded on a blockchain. This process is a fundamental concept within the Finternet, as it enables the digitization of assets, making them more accessible, divisible, and easier to transfer or trade.

Unified Ledgers: A Simple and Secure System

Unified ledgers are like a digital ledger book that helps manage many types of assets, each with its own rules and needs. For example, registered assets like houses and cars have legal protections and security. On the other hand, unregistered assets, like artwork sold privately, may be harder to verify and sell. Regulated assets, such as stocks, are well-protected for investors, while unregulated assets, like some digital tokens, have less protection. There are also attested assets, which are confirmed as genuine, and unattended assets, which aren’t verified. Understanding these differences is crucial for creating rules that help manage the benefits of digital assets while reducing risks like fraud and disputes.

Unified ledgers can manage different types of tokens based on their registration and regulation status. Registered tokens represent legally registered assets like real estate, ensuring compliance with specific standards. Unregistered tokens cover assets that don’t need formal registration, like certain digital art. Regulated tokens include financial assets like money and stocks, which follow financial regulations, while unregulated tokens encompass virtual assets outside traditional financial oversight. Attested tokens come with verified proof of authenticity, ensuring trust, whereas unattested tokens lack formal verification but still hold value in specific contexts. Additionally, tokens can be fungible (interchangeable like money), non-fungible (unique like digital art), bearer tokens (ownership based on possession), or non-bearer tokens (ownership requires identification), each serving different functions in the digital asset ecosystem.

Fraudulent Activities in Finternet?

Fraudulent activities in the DeFi space can occur due to the pseudonymous nature of cryptocurrency transactions, which often conceal the identities of participants. This anonymity can facilitate various scams, such as rug pulls, where developers withdraw funds from liquidity pools, or phishing attacks targeting users' private keys. Decentralized exchanges (DEXs) are particularly vulnerable, as they lack the oversight and security measures of traditional financial systems, making it easier for malicious actors to exploit vulnerabilities and defraud users.

Addressing frauds, such as money laundering and terrorist financing, in the Finternet requires better ways to monitor and regulate financial activities. The old methods, which rely on lots of paperwork, make it hard to detect and prevent these crimes because the evidence is often hidden and difficult to analyze. This inefficiency can lead to service disruptions and makes it easier for fraudsters to exploit the system. Moving to more modern, digital solutions can help improve detection, streamline processes, and reduce the risk of financial crimes.

So how are DEXs working against these activities? Let’s take a look at a simple example.

Kamino Finance is a decentralized lending and borrowing protocol on the Solana blockchain, utilizing a unique peer-to-pool model known as Kamino Lend (K-Lend). This system connects lenders and borrowers of crypto assets in a decentralized manner, allowing users to lend their assets to earn interest or borrow funds by providing collateral.

So how does lending and borrowing on kamino work?

Lending: Lenders put their crypto assets into separate liquidity pools, each for a different type of asset. This setup helps manage risks and set interest rates based on supply and demand for each asset. Users earn interest on their deposits, which changes according to how much their asset is used in the pool. Kamino uses a special interest rate system that adjusts rates dynamically based on how in-demand the asset is.

Borrowing: Borrowers need to provide collateral, usually in crypto assets, to secure a loan. The amount they can borrow depends on the value of their collateral and the platform's loan-to-value (LTV) ratios. After depositing collateral, they can access loans in various supported assets. Kamino also allows using liquidity pool positions as collateral, which helps maintain liquidity while still earning yield. If the value of the collateral drops too low, it may be liquidated to protect lenders and keep the lending pools stable. This liquidation process is a standard risk management feature in DeFi protocols.

Case Study - ONDC Protocol

What is ONDC?

ONDC (Open Network for Digital Commerce) is an initiative launched by the Government of India aimed at democratizing the digital commerce ecosystem. It seeks to create an open, interoperable network that allows buyers and sellers to connect and transact, regardless of the platform they are using. The concept is to break the dominance of large e-commerce platforms by enabling small businesses, local stores, and startups to participate in digital commerce on a level playing field.

Key Aspects of ONDC are:

Interoperability: ONDC enables different e-commerce platforms to interoperate, meaning that a seller on one platform can easily reach buyers on another, promoting a more open and competitive market.

Decentralisation: Unlike traditional e-commerce models dominated by a few large players, ONDC is designed to decentralise the control over digital commerce, ensuring that no single entity controls the entire network.

Inclusivity: The platform is designed to include a wide range of participants, including small retailers, artisans, and service providers who may not have the resources to build their own digital storefronts.

Standardization: ONDC sets common standards for digital commerce, such as cataloging, inventory management, order fulfillment, and payments, which all participants must follow, ensuring a seamless experience across the network.

Consumer Choice: By increasing the number of sellers and platforms available to consumers, ONDC provides greater choice and fosters competition, which can lead to better prices and services.

As ONDC continues to evolve, it is likely to integrate more closely with financial services, further blurring the lines between digital commerce and digital finance. This integration could include the use of digital wallets, decentralized finance tools, and even blockchain-based payment systems, all of which are key components of the Finternet. thank you

your research skills are top notch 🫡

ggwp