Deep Dive on State of RWAs on Solana - 2025

In the world of crypto, narratives come and go. But one has quietly matured from a theoretical concept into a rapidly scaling, multi-billion-dollar sector: Real-World Assets (RWAs). While memecoins may dominate headlines, the real tectonic shift is happening as institutional capital moves into tokenized assets.

Having expanded over 380% since 2022 to a market size of over $24 billion, RWA tokenization is no longer a niche experiment. It's attracting scaled adoption from financial giants like BlackRock, JPMorgan, and Apollo, promising to build a bridge between crypto’s hyper-liquid capital and the world’s $400 trillion pool of traditional assets.

As this opportunity solidifies, the critical question is no longer if, but where this high-stakes activity will live on-chain. While Ethereum established an early lead, Solana is now decisively emerging as a premier, high-performance venue for RWA deployment and trading. This ascent is not just theoretical; it is demonstrated by concrete market dominance and landmark partnerships.

Solana now facilitates over 95% of all tokenized stock trading volume, while simultaneously attracting foundational financial infrastructure providers like Moody’s for on-chain credit rating pilots and strategic partners like R3, which is bridging its $10B+ regulated asset ecosystem to the network.

But is this momentum sustainable, or is it just another cycle play? What’s actually live? Who’s building what? And is the infrastructure ready for institutions, or are we still in the speculative phase? This report maps the current state of RWAs on Solana—unpacking the key players, the underlying infrastructure, and the regulatory vectors. We will analyze the institutional proof points and DeFi integrations that are positioning Solana at the forefront of this movement, while critically examining the primary challenges—deep liquidity and global regulation—that it must overcome to secure its future.

A brief history of RWA’s and Tokenization

For decades, the financial world has operated in two distinct realms: the traditional, physical economy of property and contracts, and the new, digital economy of the internet. The tokenization of Real-World Assets (RWAs) represents the most significant bridge ever built between them. It’s a paradigm shift that promises to fundamentally rewire how we own, trade, and interact with value.

At its core, the concept is remarkably simple. An RWA is a digital token on a blockchain that represents a verifiable ownership claim on a tangible, off-chain asset. Think of it as a digital title deed for a portion of an office building, a digital certificate for a share of private credit, or a tokenized representation of a US Treasury bill. By converting physical or traditional financial assets into digital tokens, we aren't just creating a digital copy; we are combining them with the native properties of the internet: speed, global reach, and programmability.

This simple act of tokenization unlocks a value proposition measured in the trillions of dollars. The primary benefit is a massive addition of liquidity into markets that have been historically stagnant and inefficient. Assets like commercial real estate, fine art, or private equity are notoriously illiquid, often taking months and significant legal overhead to sell.

Tokenization shatters these barriers through fractionalization, allowing an asset to be digitally divided into thousands of smaller, more affordable pieces. This opens the door to a global pool of investors and creates dynamic, 24/7 markets, replacing the archaic 9-to-5, weekday-only schedules of traditional exchanges. Furthermore, by automating processes like compliance, settlement, and dividend payments through smart contracts, tokenization drastically cuts down on the army of intermediaries and paperwork, creating radical new efficiencies.

This is not a monolithic movement; it's just unfolding across several key segments, each a colossal market in its own right. The largest and most mature is Private Credit, a $1.7 trillion market of non-bank corporate lending that is now being brought on-chain. Real Estate follows closely, with tokenization offering a solution to the age-old problem of illiquidity in property markets.

Tokenized Treasuries have emerged as the "gateway RWA," providing a low-risk, high-demand entry point for institutional capital to get comfortable with on-chain assets. Finally, Equities, or tokenized stocks of public companies, are proving to be a powerful use case for enabling global, round-the-clock trading access. Understanding these core verticals is crucial, as they form the battleground where the future of finance is being built—and where Solana is rapidly emerging as a dominant force.

The Solana Advantage: Why Here? Why Now?

For Real-World Assets to move on-chain at a global scale, the underlying blockchain cannot be a mere database; it must function as a high-performance financial settlement layer. The theoretical benefits of tokenization—liquidity, efficiency, 24/7 markets—are instantly nullified by high transaction fees, slow settlement, and network congestion. While many blockchains can store value, very few are architecturally designed to transact value at the speed and cost that financial markets demand. This is Solana’s fundamental advantage. Its suitability is not an accident of its ecosystem, but a direct consequence of its core design.

Performance as a Prerequisite: An Architecture for Finance

To understand why Solana is uniquely positioned, one must look past simple metrics and into its core architecture. The network's ability to process tens of thousands of transactions per second with sub-second finality and near-zero cost isn't just a feature; it's a prerequisite for handling high-frequency use cases like tokenized forex, equities, and derivatives. This is achieved through a combination of unique innovations:

Proof of History (PoH): This is Solana's most critical innovation. Before PoH, blockchains had to communicate back and forth to agree on the time and order of transactions, creating a massive bottleneck. PoH creates a verifiable, cryptographic clock, allowing validators to timestamp and order transactions independently without waiting for consensus. For finance, this is crucial. It enables the network to process transactions in a continuous, sequential flow, mirroring the architecture of a real-time system like NASDAQ's order matching engine rather than a slow, batch-processing system.

Parallel Processing for Transactions. Traditional blockchains like Ethereum process transactions sequentially in a single thread, like a single-lane road. Solana’s Sealevel runtime can process tens of thousands of smart contracts in parallel, like a multi-lane superhighway. It identifies all non-overlapping transactions in a block and executes them simultaneously. This is essential for RWAs, where thousands of unrelated transfers, trades, and dividend payments can occur at once without slowing each other down.

Turbine: Efficient Block Propagation. Solana’s Turbine protocol breaks down large blocks of transactions into smaller, more manageable packets that are broadcast across the network. This drastically reduces the bandwidth required for validators to stay in sync, preventing network congestion and ensuring that performance remains high even under heavy load—a critical consideration for institutional-grade reliability.

Together, these features mean that a transaction on Solana costs a fraction of a cent (~$0.00025) and is settled almost instantly. For an asset manager tokenizing a credit fund or a market maker trading tokenized stocks, this isn't just a "nice-to-have"—it's the difference between a viable product and a non-starter.

A Growing Institutional Toolkit: Building for Compliance and Complexity

High performance is useless without the tools to manage complex, regulated financial assets. Solana has moved aggressively to build a native, on-chain toolkit that gives issuers the control they need without sacrificing performance.

Token Extensions : This is arguably the most important development for RWAs on Solana. It is an evolution of the standard SPL token that embeds complex, institutional-grade logic directly at the token level. Issuers no longer need to rely on clunky, external smart contracts for core functionality. Key features include:

Transfer Hooks: A powerful tool that allows issuers to enforce on-chain KYC/AML checks. A transfer of a tokenized security can "hook" into a program that verifies both the sender and receiver are on an approved whitelist before the transaction is allowed to proceed.

Confidential Transfers: Using this allows the amount and parties of a transaction to be shielded, a non-negotiable requirement for institutions that cannot broadcast their positions publicly.

Interest-Bearing Tokens: The ability to have tokens accrue yield natively, essential for tokenizing bonds, treasuries, or private credit funds.

Permanent Delegate Authority: Allows an issuer to retain certain controls over an asset, such as the ability to freeze or reclaim tokens in response to a court order, a crucial feature for regulated securities.

Solana Permissioned Environments (SPEs): For institutions that require a private, "walled garden" environment, SPEs allow for the creation of a custom, private instance of the Solana Virtual Machine (SVM). This provides the performance of Solana with the privacy and control of a permissioned ledger, allowing firms to experiment and build with confidence before deploying to the public mainnet.

State Compression and cNFTs: Solana's state compression technology dramatically reduces the cost of minting and storing tokens on-chain by over 99.9%. This makes it economically feasible to tokenize millions of individual assets, such as individual loans in a securitized portfolio or shares in a real estate fund, as compressed NFTs (cNFTs) for just a few hundred dollars.

The Flywheel Effect: Tapping into a Tested Ecosystem

Finally, Solana's advantage is amplified by its existing, vibrant ecosystem. New RWA protocols are not launching into a vacuum; they are plugging into a network with deep liquidity, sophisticated users, and battle-tested infrastructure.

Native Order Book DEXs: Solana's architecture is uniquely suited for central limit order books (CLOBs), the standard for all traditional financial exchanges. Platforms like Phoenix and Openbook provide the high-frequency trading environment necessary for liquid RWAs like tokenized stocks, enabling tighter spreads and more complex trading strategies than the Automated Market Makers (AMMs) common on other chains.

DeFi Composability: The true power of tokenization is used yo maximum when RWAs can be used as collateral within DeFi. On Solana, a user can take a tokenized US Treasury from a platform like Ondo Finance and use it as pristine collateral on a lending protocol like Kamino or MarginFi to borrow other assets. This composability—turning an idle asset into a productive financial tool—creates a powerful flywheel effect, attracting more assets and more users to the ecosystem.

Robust On/Off-Ramps and Oracles: With support from nearly all major fiat on-ramps, bridges like Wormhole, and crucial data oracles like Pyth and Switchboard, the core infrastructure needed to connect RWAs to off-chain data and the broader multi-chain world is already mature and in place.

Solana’s speed, low fees, and composability make it an ideal foundation for real-world asset protocols — whether it’s tokenized gold, uranium, real estate, or collectibles. But this isn’t just theory.

The State of Real World Assets on Solana

On-Chain Equities: A Deep Dive into xStocks

The on-chain equities market underwent a steep shift in mid-2025 with the launch of the xStocks platform on Solana. This initiative by the Swiss-based issuer Backed Finance, demonstrated Solana's capacity to not only attract but rapidly dominate new, high-potential RWA categories.

The Launch and Immediate Market Capture

On June 30, 2025, Backed Finance, in a coordinated effort with major centralized exchanges Kraken and Bybit, alongside key Solana DeFi protocols, launched its xStocks product line. This coalition, dubbed the "xStocks Alliance," was designed to ensure broad accessibility and deep liquidity from the outset, a strategy that proved remarkably effective.

The impact was immediate and decisive. Within days of going live, the xStocks platform captured over 95% of the total trading volume for tokenized stocks across all blockchain networks. This rapid consolidation of market share underscores Solana's ability to serve as a premier venue for high-frequency financial applications, a feat attributable to its low-latency settlement and minimal transaction costs

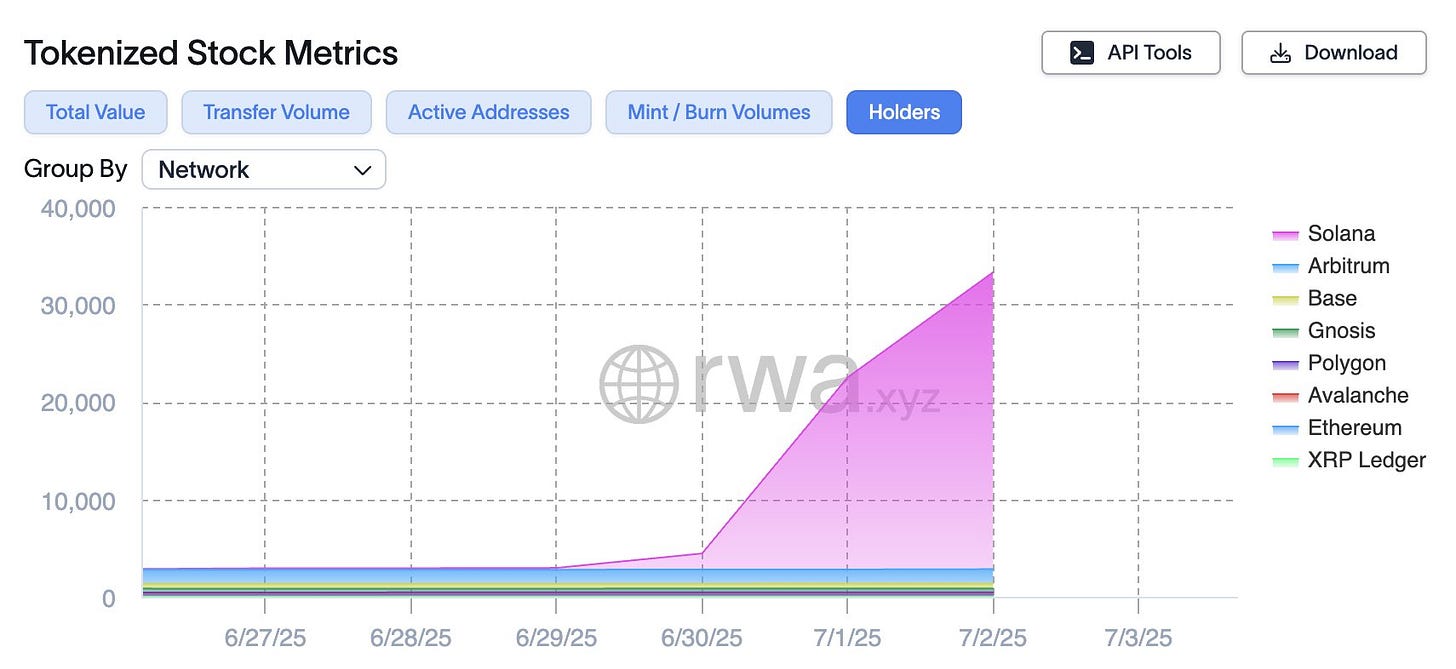

Market Performance and User Adoption Metrics

The platform's initial performance metrics provide a clear picture of strong market interest and user confidence. Trading volume surged past $1.3 million on its first day of operation. Activity peaked on July 2, when the tokenized S&P 500 ETF ($SPYx) alone recorded $4.67 million in daily volume, accounting for over half of all trading activity on the platform that day. While volumes subsequently moderated to $3.81 million by July 4 as initial excitement cooled—a typical pattern for new financial product launches—the platform demonstrated significant asset retention and user growth.

Despite fluctuating daily volumes, total Assets Under Management (AUM) on xStocks reached $48.6 million by July 3, indicating that users were not just trading but holding these assets on-chain. This was accompanied by rapid user adoption, with over 20,000 unique wallets holding tokenized stocks shortly after launch. Investor preference clearly skewed towards well-known, blue-chip assets. The $SPYx token proved to be the most popular, held by more than 10,000 wallets, followed by $TSLAx (Tesla) with 8,100 holders and $NVDAx (Nvidia) with 5,500 holders.

User Experience and Asset Availability

The xStocks platform offers a fundamentally different user experience compared to traditional stock trading. By leveraging Solana's infrastructure, it enables 24/7 trading (or 24/5 on exchanges like Kraken), breaking free from legacy constraints like market hours and T+2 settlement delays. This provides global users, particularly those outside the U.S., with unprecedented access to American equity markets.

The platform launched with a diverse portfolio of 60 assets, including 55 individual stocks and 5 ETFs. The selection covers a wide range of popular securities, from technology giants like Apple ($AAPLx), Microsoft ($MSFTx), and Amazon ($AMZNx) to crypto-native public companies such as Coinbase ($COINx) and MicroStrategy ($MSTRx). It also includes broad market ETFs like the S&P 500 ($SPYx) and Nasdaq-100 ($QQQx), allowing for diversified, passive investment strategies on-chain.

Each xStock is a fully collateralized Solana SPL token, backed 1:1 by the corresponding real-world share. These underlying assets are held by regulated custodians, and the reserves are verifiable on-chain through Chainlink's Proof of Reserve system, providing a layer of transparency absent in many traditional financial structures.

DeFi Composability:

Lending & Borrowing: Users can deposit xStocks as collateral in leading Solana lending protocols like Kamino. For example, an investor could use their tokenized Microsoft shares ($MSFTx) to borrow stablecoins, accessing liquidity without selling their equity position. This functionality turns passive holdings into productive assets.

Liquidity Provision & Trading: xStocks are seamlessly tradable on Solana's largest decentralized exchanges (DEXs). Raydium serves as the primary automated market maker (AMM) and liquidity hub, allowing users to provide liquidity to pools such as TSLAx/USDC and earn trading fees. Meanwhile, DEX aggregators like Jupiter route trades across multiple venues to ensure users receive the best possible price with minimal slippage

This integration creates a powerful synergy. DeFi protocols add utility to tokenized stocks, while these blue-chip assets offer a seamless, on-chain "flight to quality." Traders can rotate profits from volatile assets, like memecoins, directly into tokenized ETFs such as $SPYx without ever leaving the Solana network. This closed-loop system enhances capital "stickiness," and the high concentration of volume in $SPYx suggests its use is for strategic capital preservation, not just speculation.

However, significant challenges remain for institutional adoption. A liquidity paradox exists: while dominating the tokenized market, xStocks' absolute volume is a fraction of traditional markets, preventing large institutional trades. Additionally, holders gain only economic exposure, lacking direct shareholder rights like voting. Finally, the model's reliance on a single issuer and its custodians introduces significant centralized counterparty risk, which runs counter to the decentralized principle of crypto.

Jupiter-AIX Partnership:

Complementing the secondary trading of existing stocks, Solana's leading DEX aggregator, Jupiter, has partnered with the Astana International Exchange (AIX) in Kazakhstan. This collaboration aims to create a novel "dual listing" mechanism. This framework will allow companies to conduct a traditional Initial Public Offering (IPO) on the regulated AIX while simultaneously issuing a tokenized version of their shares on the Solana network. These tokenized shares can then be managed and traded using Jupiter's collection of decentralized financial tools. This initiative creates an efficient pathway for new companies to access both traditional and digital capital markets from day one

.

Private Credit & Debt: Wall Street Meets Solana

While tokenized equities have captured significant retail and media attention, the private credit vertical serves as a more potent indicator of deep, institutional adoption of Solana. These are complex, high-value, and highly regulated assets traditionally confined to the portfolios of large institutions. Their arrival and integration on Solana validate the chain's capacity to function as serious financial market infrastructure, capable of meeting the stringent demands of Wall Street firms.

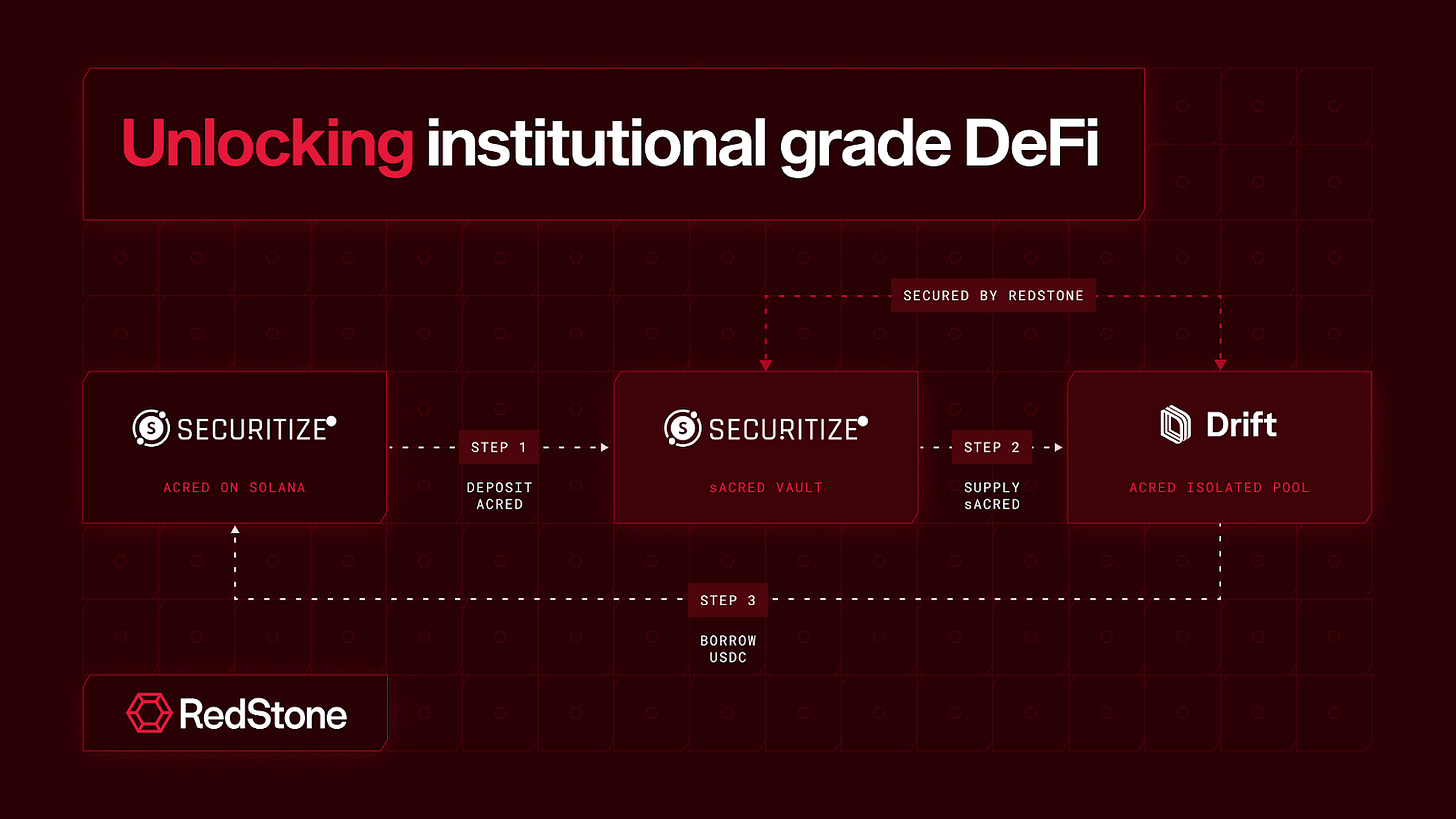

Case Study 1: The Apollo-Securitize Integration (ACRED)

A landmark development in this space is the Apollo Diversified Credit Securitize Fund (ACRED), a tokenized feeder fund that provides on-chain access to the private credit strategies of Apollo Global Management, a global asset manager with trillions under management. The fund, which invests in assets like corporate direct lending and asset-backed loans, recently surpassed $100 million in on-chain AUM, showing massive demand from institutional and accredited investors.

ACRED is issued as a multi-chain asset by Securitize, a leader in digital asset securities. Its deployment on Solana, using the advanced Token-2022 standard, was a strategic decision to utilise the network's high performance and low transaction costs for institutional-grade operations. On-chain data confirms that a meaningful portion of ACRED's token supply and transaction activity now resides on Solana.

The most critical aspect of this integration is its extension into Solana's DeFi ecosystem. Kamino Finance, a prominent lending and borrowing protocol, has onboarded ACRED as a collateral asset. This allows accredited investors to deposit their ACRED tokens and borrow other assets against them, unlocking liquidity from what is traditionally a highly illiquid asset class. This collaboration represents a true bridge between a regulated, permissioned TradFi product and the permissionless world of DeFi, creating a powerful new hybrid financial model.

Case Study 2: Centrifuge's Expansion and the deRWA Standard

Centrifuge, a pioneering RWA protocol originally built on Ethereum and Polkadot, has made a strategic expansion to Solana, recognizing the network's superior performance and composability for RWA use cases. The expansion was initiated with the launch of a $400 million tokenized U.S. Treasury fund,managed by Anemoy.

At the core of this initiative is Centrifuge's deRWA token standard. Unlike the more restrictive, permissioned models used by some issuers, deRWA tokens are designed to be "freely transferable" and seamlessly integrated with DeFi protocols from day one.

This standard prioritizes composability and open access, allowing tokens to "move at Solana speed" and be used like any other native crypto asset. Immediately upon launch, deJTRSY was available for swapping on Raydium, for use as collateral on Kamino, and for deployment in structured yield strategies on the Lulo aggregator. This functionality is supported by a strong technical foundation, using the Wormhole bridge for cross-chain capital movement and the Pyth Network for real-time, verifiable price feeds.

DeFi Platforms Embracing RWAs (Maple, Credix)

Maple Finance: A leading institutional lending protocol with over $1.2 billion in active loans globally, Maple expanded its operations to Solana in June 2025. It deployed its yield-bearing stablecoin, syrupUSD, which is backed by a diversified pool of secured private credit loans, with an initial $30 million in liquidity on prominent Solana DeFi platforms like Kamino and Orca. Maple's CEO cited Solana's "high-speed, high-capacity environment" as the ideal setting to reach a broader class of users.

Credix: This private credit marketplace is built natively on Solana to connect global investors with high-quality credit opportunities in emerging markets, particularly Latin America. Credix leverages Solana's efficiency to tokenize debt facilities and automate complex capital market workflows, addressing the high cost of capital for small and medium-sized enterprises. The platform has successfully launched fully insured USDC receivables pools with backing from the Solana Foundation, demonstrating a novel, secure model for on-chain credit

The integration of institutional-grade assets like ACRED into DeFi protocols marks the genesis of a true hybrid financial system. It is a symbiotic, two-way bridge: TradFi asset managers like Apollo gain access to a novel, global, and highly efficient channel for distribution and liquidity, while DeFi protocols like Kamino gain access to stable, high-quality, non-crypto-correlated collateral. This dynamic moves DeFi from being a parallel financial system to becoming an integrated capital allocation and leverage layer for the traditional economy. It creates a pathway for a portion of the world's $1.7 trillion+ in private credit AUM, and potentially trillions more in other TradFi assets, to flow on-chain, with Solana serving as a primary settlement and utility venue.

Stablecoins & Tokenized Treasuries: The Foundational Layer

Underpinning the more complex applications of on-chain equities and private credit is the most critical RWA vertical of all: stablecoins and tokenized treasuries. These assets serve as the foundational infrastructure for the entire on-chain economy, providing the two essential primitives of any modern financial system: a stable unit of account for commerce and a baseline "risk-free" rate for investment and risk pricing.

Fully-Backed Stablecoins as the Settlement Rail

The growth of stablecoin supply on Solana has been explosive, increasing over seven times in just 18 months from approximately $1.5 billion to $11.7 billion. This deep pool of liquidity, dominated by fully-backed and regulated stablecoins like Circle's USDC, acts as the primary settlement medium for RWA transactions. Circle's decision to mint $1.75 billion of USDC directly on Solana in May 2025 alone highlights the network's strategic importance as a core settlement layer for institutional-grade digital dollars.

This liquidity is not just sitting idle. Through a strategic integration with R3, institutions using the enterprise-grade Corda blockchain can now settle tokenized asset transfers directly on Solana using USDC. This enables atomic delivery-versus-payment (DvP) settlement—where the asset and payment are exchanged simultaneously—eliminating counterparty risk and the need for costly intermediaries.

The Rise of Tokenized T-Bills: The On-Chain "Risk-Free" Rate

Parallel to the growth of stablecoins, there has been the rise of tokenized U.S. Treasury bills. The market for on-chain U.S. Treasuries expanded from less than $100 million in January 2023 to approximately $7.5 billion by June 2025, an explosive growth of 7,400%. Some industry estimates place the market even higher, having crossed the $10 billion threshold in mid-2025, as investors sought on-chain access to the safety and yield of government debt. These assets are digital tokens, typically issued on public blockchains, that represent ownership of short-term U.S. government bonds. By tokenizing T-bills, issuers can offer fractional ownership, 24/7 trading, and automated yield distribution via smart contracts, democratizing access to what was once an asset class reserved for large institutions.

Solana has become a key destination for the world's largest financial institutions and leading crypto-native firms looking to issue these products. This influx includes tokenized treasury funds from TradFi giants like BlackRock (the BUIDL fund) and Franklin Templeton (the FOBXX/BENJI fund), as well as innovative offerings from RWA-focused protocols like Ondo Finance (OUSG and the yield-bearing stablecoin USDY) and Centrifuge (deJTRSY).

BlackRock’s $2.9B BUIDL Fund on Solana

Arguably the most significant institutional validation for any blockchain in the RWA space, the expansion of BlackRock's flagship tokenized Treasury fund, BUIDL, to the Solana network in March 2025 marked a pivotal moment. BlackRock, the world's largest asset manager with over $10 trillion in AUM, chose Solana as one of the select public blockchains for its first tokenized fund.

The strategic rationale was explicit. Securitize, BlackRock's tokenization partner, described the expansion to Solana as a "natural next step," directly citing the network's superior speed, scalability, and cost-efficiency as key decision factors. The BUIDL fund, which offers qualified investors on-chain access to U.S. dollar yields, now leverages Solana to provide near real-time, 24/7 peer-to-peer transfers, a capability impossible in traditional financial plumbing.

Franklin Templeton’s On-Chain Government Money Fund (FOBXX)

Franklin Templeton, a global asset manager with $1.7 trillion in AUM, extended its Franklin OnChain U.S. Government Money Fund (FOBXX) to Solana in February 2025. As the first U.S.-registered mutual fund ('40 Act fund) to use a public blockchain for maintaining its share ledger, FOBXX's adoption of Solana carries significant weight.

The firm's digital asset arm explicitly stated its intent to use Solana's "fast, secure and censorship resistant" network to enhance its on-chain operations. By choosing Solana, Franklin Templeton not only expanded the accessibility of its fund but also provided a powerful endorsement of the network's ability to meet the rigorous operational, security, and compliance standards required for a publicly registered U.S. security. This development proves that Solana's infrastructure is viewed as a viable and compliant alternative to traditional record-keeping systems for even the most regulated financial instruments

R3’s Corda with Solana

In a landmark partnership that bridges the worlds of private and public blockchains, enterprise blockchain firm R3 is integrating its bank-focused Corda platform with the Solana public network.

The integration is designed to solve the long-standing challenge of interoperability, allowing R3's ecosystem of regulated financial institutions to access the liquidity and utility of a public blockchain while maintaining the privacy and control of their permissioned environment. The technical solution is elegant: it effectively moves Corda's "notary" function—the service that prevents double-spending—onto Solana. This means private Corda transactions will be confirmed by Solana's global network of validators, enhancing security and decentralization while reducing operational costs for Corda users. The partnership aims to create a seamless bridge for the $10 billion+ in regulated assets currently on R3's permissioned networks to flow into the Solana ecosystem, enabling use cases like atomic settlement of Corda assets against Solana-based stablecoins.

Commodity and Exotic Asset Tokenization

Demonstrating the breadth and flexibility of its ecosystem, Solana is also a hub for the tokenization of a diverse range of assets beyond traditional financial instruments.

Uranium Digital — The First Onchain Uranium Market

Uranium Digital is building a 24/7 spot market for tokenized uranium (yellowcake), backed by real-world storage.

Each token = 1 lb of uranium stored at verified facilities

Instant trading & settlement for KYC/KYB-cleared institutions

It replaces slow, opaque RFQs and forward contracts — offering transparency, real-time price discovery, and efficient sourcing in a market with a 25% supply gap.

Oro — Tokenized Gold with Real Yield

Oro brings physical gold onchain via two Solana-based tokens:

GOLD — Backed 1:1 by real gold in secure vaults. Mint/redeem anytime (1% fee), with USDC redemptions settled in T+2.

stGOLD — A yield-bearing version of GOLD, earned by leasing to institutional borrowers.

Fully compliant, with monthly attestations and KYC required.

Oro removes barriers like import restrictions, high taxes, and poor infrastructure — giving global users transparent, 24/7 access to gold.Parcl — Trade Real Estate Like Crypto

Parcl lets users trade the price of housing markets (like NYC, Chicago, etc.) without owning property.

Synthetic indexes update daily from 100M+ data points

Long/short with up to 20x leverage

34 markets live | $10M+ TVL

No REITs, no mortgages — just real estate exposure with high liquidity.

Built on Solana for low fees & fast trades.VNX Gold (VNXAU) — Onchain LBMA-Certified Gold

VNXAU is a multichain token backed 1:1 by real physical gold stored in secure vaults in Liechtenstein.

Fully backed by LBMA-certified gold

Available on Solana and other chains

Offers direct, digital ownership of gold with full transparency

It gives users easy, compliant access to real gold — without the friction of traditional gold investing.

Homebase & MetaWealth — Fractional Real Estate on Solana

Homebase (U.S.) and MetaWealth (Europe) make real estate investing accessible by tokenizing property ownership using Solana NFTs.

Invest with small amounts

Own fractional shares of real-world properties

Receive on-chain rental income

They simplify global real estate access and turn rental yield into a seamless digital experience.

Fine Art & Collectibles: Baxus — Tokenizing Fine Spirits & Collectibles

Baxus turns collectible wines and spirits into tradable tokens on Solana.

Backed by high-value physical bottles

NFT-based marketplace for rare & illiquid assets

Enables 24/7 global trading of passion assets

Institutions are not merely using Solana as a faster and cheaper alternative to existing ledgers. They are using it as a foundational institutional application layer to build entirely new, hybrid financial products and systems that were previously impossible. This workflow can be seen in three distinct stages:

Replication for Efficiency: At the first level, institutions like BlackRock and Franklin Templeton use Solana to make existing financial products, such as money market funds, more efficient. They achieve 24/7 settlement, reduce operational overhead, and broaden distribution channels. This is a direct replication and improvement of traditional finance.

Enhancement through Composability: At the second level, companies like Apollo and Maple Finance use Solana to make existing assets, like private credit, programmable. An ACRED token is not just a static representation of a fund share; it becomes a dynamic, yield-bearing "money lego" that can be plugged into DeFi protocols like Kamino to create novel outcomes, such as leveraged returns. This is a fundamental enhancement of traditional finance.

Transformation through Innovation: At the highest level, partnerships like those with R3 and the Jupiter-AIX initiative represent a true transformation. R3 is embedding Solana as a core consensus and settlement component of its own enterprise architecture, outsourcing a critical function to a public chain. The Jupiter-AIX model creates a fundamentally new, hybrid capital formation process that is digital-native by design.

The Ecosystem Flow: A Value Chain Visualization

The Solana RWA ecosystem can be visualized as a multi-stage value chain that transforms an off-chain asset into a programmable on-chain primitive. This flow illustrates how various players collaborate to deliver value to the end investor.

Asset Originators: The process begins in the off-chain world with an entity that owns or creates a valuable asset. This could be a real estate developer with a portfolio of properties, a private credit fund like Apollo originating loans, a government issuing bonds, or a company seeking to go public.

Tokenization Platforms & Issuers: Specialized firms like Securitize and Backed Finance provide the critical legal and technical infrastructure to create the asset's "digital twin." This involves legal structuring (often using an SPV), asset valuation and verification, and the minting of digital tokens (e.g., SPL tokens or NFTs) on the blockchain that represent a legal claim to the underlying asset.

Solana Network: The Solana blockchain serves as the core infrastructure layer. It provides the global, decentralized ledger for recording ownership and transfers. Its key features—high throughput, low fees, and fast finality—ensure that transactions are settled almost instantly and at a negligible cost, making the entire system viable at scale.

DeFi Applications (The "Action" Layer): This is where the tokenized assets come to life. Decentralized exchanges (Jupiter, Raydium), lending protocols (Kamino, Morpho), and non-custodial wallets (Phantom) provide the interfaces and smart contract logic that allow users to interact with the RWAs. This layer enables trading, lending, borrowing, yield farming, and other financial activities.

Investors (End Users): The final recipients of this value chain are the end users. This diverse group includes large institutions and DAOs managing their treasuries, sophisticated DeFi traders seeking new yield opportunities, and individual retail investors looking to gain fractional exposure to previously inaccessible asset classes

Global Regulatory Compliance for Tokenized Assets

The regulatory approach to real-world asset tokenization varies widely across regions — shaping where and how protocols can grow.

🇺🇸 United States applies existing securities laws to tokenized assets. There’s no dedicated RWA framework yet, but private placements (e.g. Reg D, Reg S) and tokenized shares of registered entities are active paths. Institutions like BlackRock, Franklin Templeton, and KKR have launched tokenized funds under current rules. Broker-dealers like Securitize play a key role in enabling compliant issuance. A regulatory shift post-2024 could accelerate broader adoption.

🇪🇺 European Union is taking a sandbox approach. While MiCA doesn’t cover tokenized securities, the DLT Pilot Regime (2023–26) enables experimentation under controlled conditions. Countries like Germany, France, Switzerland, and Liechtenstein are passing enabling laws for DLT-based bonds, funds, and shares. Major banks like UBS, HSBC, and SocGen are already participating.

🇸🇬 Asia is leading on regulatory clarity. Singapore's MAS has moved from pilot to commercialization with Project Guardian, licensing platforms like InvestaX for tokenized securities. Hong Kong has launched STO guidelines, and Japan has passed laws for security tokens. The region views tokenization as a competitive advantage in global finance.

🇦🇪 Middle East is positioning itself as a tokenization hub. UAE’s VARA and Abu Dhabi’s ADGM have frameworks for tokenized securities. Projects like real estate tokenization in Dubai and investment by Saudi Aramco reflect national-level interest. Jurisdictions like Kazakhstan are building special zones aligned with Solana for token trials.

Across regions, a common trend is emerging: RWAs are not being banned — they’re being shaped into regulated, compliant financial products.

Improving Market Efficiency and Liquidity

RWA tokenization addresses fundamental inefficiencies that have plagued traditional financial markets for decades, particularly in relation to illiquid assets.

By converting assets like real estate or private credit into standardized digital tokens, RWAs unlock massive liquidity. These tokens can be traded on global, 24/7 markets, eliminating the constraints of traditional exchange hours and national holidays.

Furthermore, blockchain technology enables near-instantaneous settlement (atomic settlement), a dramatic improvement over the T+1 or T+2 settlement cycles common in legacy systems. This reduces counterparty risk and frees up capital that would otherwise be tied up in transit.

This newfound liquidity and programmability enables the creation of entirely new financial products. We are already seeing the emergence of RWA index funds, which provide diversified exposure to a basket of tokenized assets.

More sophisticated strategies, such as the leveraged yield products being built on Kamino using Apollo's ACRED token, demonstrate the potential for RWA-native financial engineering. Crucially, high-quality RWA tokens can be used as stable, reliable collateral in DeFi lending protocols, increasing capital efficiency across the entire digital asset ecosystem and providing a more sustainable foundation for DeFi yields.

This opens up business models such as Tokenization-as-a-Service (TaaS) platforms like Securitize and Backed Finance, which provide the end-to-end technical and legal infrastructure for asset owners to bring their holdings on-chain.

We are also seeing the rise of CeDeFi collaborations, where hybrid models emerge, such as traditional insurance companies underwriting on-chain credit pools on platforms like Credix, or regulated custodians providing essential services to DeFi protocols.

Finally, the stringent need for regulatory compliance is driving innovation in on-chain identity and permissioning solutions, creating a new market for tools that can enforce KYC/AML rules at the protocol level.

While the momentum around RWAs on Solana is undeniable, the road to mainstream adoption comes with real challenges. These aren’t just technical hurdles — they span regulation, legal clarity, and trust. For the ecosystem to scale responsibly, several key issues need to be addressed:

Regulatory Uncertainty: Fragmented global rules make compliance complex and expensive.

Technology Risk: Smart contract bugs, oracle failures, or network issues can lead to major losses.

Legal Enforceability: Tokens must have a clear, enforceable legal link to the real-world asset.

Investor Confidence: Building trust requires education, transparency, and a strong security track record.

Conclusion

Bringing financial assets on-chain isn’t a question of if anymore — it’s a matter of when and how big. The benefits are obvious: faster settlement, greater transparency, lower costs, and global access. The old system can’t compete with that forever.

Solana has gone from being “just another high-speed chain” to becoming the base layer for serious institutional activity — from asset managers like BlackRock to tokenized equities and real-world asset markets across gold, real estate, and beyond.

But the real upside doesn’t stop at making TradFi faster. The real opportunity is in building entirely new financial systems — ones that couldn’t exist before. Imagine DAOs funding infrastructure, sovereign bonds issued directly onchain, or complex financial products running as smart contracts.

References:

https://chatgpt.com/share/68612529-bb5c-8004-93fa-6b0b59c9955f

https://onchain.org/research/real-world-assets-for-real-world-purposes-an-impact-analysis/

https://app.rwa.xyz/

https://www.helius.dev/blog/solana-real-world-assets#real-estate

https://blog.redstone.finance/2025/06/26/real-world-assets-in-onchain-finance-report/

https://yashhsm.medium.com/state-of-real-world-assets-on-solana-the-opportunities-23ebff9a50c9

https://cryptorank.io/news/feed/1ff62-private-credit-drives-24-billion-tokenization-boom-redstone-report#:~:text=By%20June%202025%2C%20this%20market,time%20high%20of%20%2424.31%20billion

https://cointelegraph.com/news/franklin-templeton-us-govt-money-fund-solana

https://aix.kz/aix-intebix-solana-foundation-and-jupiter-signed-a-landmark-mou-to-explore-dual-listings-and-blockchain-integration/#:~:text=AIX%2C%20Intebix%2C%20Solana%20Foundation%20and,Listings%20and%20Blockchain%20Integration%20%7C%20AIX

https://phemex.com/blogs/wall-street-tokenized-assets-rwa-2025

https://cv5capital.medium.com/tokenization-of-u-s-treasury-bills-a-new-frontier-in-on-chain-finance-9a3414bb9cd6

https://www.bitget.com/news/detail/12560604797035

https://www.dlnews.com/articles/defi/plume-blockchain-110m-record-highlights-19t-tokenisation-opportunity/

https://www.ledgerinsights.com/r3-pivots-to-public-blockchain-with-solana-partnership/

https://www.coindesk.com/markets/2023/07/26/crypto-lender-credix-brings-opens-private-credit-pool-on-solana-with-11-yield#:~:text=Crypto%20Lender%20Credix%20Brings%20Additional,with%20Solana%20Foundation%20among%20investors

https://solana.com/pl/news/case-study-homebase#:~:text=Homebase%20tokenized%20a%20%24235%2C000%20single,with%20a%20minimum%20%24

https://www.theblock.co/post/340432/franklin-templeton-extends-fobxx-fund-to-solana

https://solana.com/pl/solutions/real-world-assets

https://22049776.fs1.hubspotusercontent-na1.net/hubfs/22049776/TAC%20State%20of%20Tokenization%202024%20Report.pdf